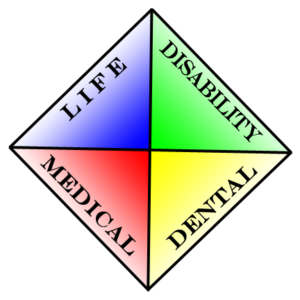

Shober Employee Benefit Services works with our clients to develop a solid employee benefits program, centered around medical, dental, life, and disability insurance. This strategy, Four Corners of a solid employee benefits program, takes into account your current program, needs of employees and senior management, and costs to create a program that reduces expenses while ensuring employee satisfaction.

Medical: Gaining a deeper understanding of the clients wants and needs for themselves and employees who participate or share the  cost of the program. We listen to current likes and dislikes about the current program or vendors. Our most common answers for clients relate to cost in these ways; Features or the design of the program; Benefits or how much the insurance company will pay, Financial responsibility of the member or how much do they pay at the hospital, doctors office or pharmacy; Administrative issues that range from billing, product awareness and educational meetings and materials, enrollments, terminations, contract interpretation, contract negotiation and COBRA.

cost of the program. We listen to current likes and dislikes about the current program or vendors. Our most common answers for clients relate to cost in these ways; Features or the design of the program; Benefits or how much the insurance company will pay, Financial responsibility of the member or how much do they pay at the hospital, doctors office or pharmacy; Administrative issues that range from billing, product awareness and educational meetings and materials, enrollments, terminations, contract interpretation, contract negotiation and COBRA.

Group Dental Insurance: The most requested employee benefit by employees is dental insurance. It is the program which people use regularly and provides great value. Our clients provide usually one or two programs where they may contribute or pay 100% of the program’s premium for employees or offer the programs to employees as a Voluntary option where the employee pays 100% of the program.

Life Insurance: Group Life programs are often over looked and ignored by companies and employees until it’s too late. It’s the easiest way for employees to have coverage that’s comprehensive and affordable. Life Insurance is usually sold to the group just like medical with one rate for everyone. Our clients usually provide one or two options that they will contribute or pay 100% of the cost with options for employees to insure themselves with additional coverage at 100% cost to them.

Group Disability: Short Term and Long Term Disability can be one of the most important programs employers and employees are offered behind the medical. It insures the obvious need for income replacement when an employee can’t work. Many employees live pay check to pay check and if they become sick or injured while not on the job, they need a program to help them stay financially afloat. Most programs are 60% of salary to a fix weekly or monthly amount. All programs are based upon salary and job occupations which determine the cost.

Ready to find out more?

Get a Quote today!